Table Of Content

There needs to be an element of trust in the universe giving them what they attract. "It's so important to bring in your values with manifestation because sometimes we can get really confused with what we want, with social media especially," she told me. Tansy charges anywhere from £25 to £580 for her courses, which range from one-on-one sessions and an online six-week programme, to forest bathing workshops and weekend-long nature retreats. "It's happened on so many occasions, like four, five times," he said. "I've become very clear on what I want and the amount of money I need and literally it can be within 24 hours that I get a phone call for a job and it's almost identical to what I asked for money-wise." Johnson’s reliance on Democratic votes to pass key pieces of legislation, including a major government funding bill that cleared the House last month, has outraged some hard-right Republicans.

Faster, easier mortgage lending

Therefore a larger down payment will generally result in the lower amount paid on interest for borrowed money. For conventional loans, paying at least a 20% down payment when purchasing a home removes the need for Private Mortgage Insurance (PMI) payments, which are sizable monthly fees that add up over time. But, briefly, anyone who makes a down payment smaller than 20% of the home’s purchase price must pay monthly private mortgage insurance premiums. The sole exception is for those with VA loans, which don’t do continuing mortgage insurance. Your estimated annual property tax is based on the home purchase price. The total is divided by 12 months and applied to each monthly mortgage payment.

How do down payments work?

You can also visit your state and local government housing agency departments for details. Many lenders recommend a DTI below 43%, but some programs allow a maximum of 50%. Additionally, having a good credit score of 670 or above helps you qualify for lower rates and fees, as lenders perceive less risk. If you’re living in a high-cost metro area, you may need a jumbo loan to afford a home. The down payment requirements for jumbo loans vary by lender and range from 10% to 30%, with 20% being the most common threshold.

Conforming loans vs non-conforming loans

The average down payment on a home is 12%, according to the National Association of Realtors. Fortunately, with the wide range of home loans available in today’s market, it’s possible to buy a home with as little as 3% down. You can even put 0% down if you qualify for a down payment assistance program, a VA loan or a USDA loan. The size of your down payment doesn’t need to deter you from buying a home. His work has been featured on several financial and media websites. The average down payment for a house differs widely by state due to different home prices.

How We Make Money

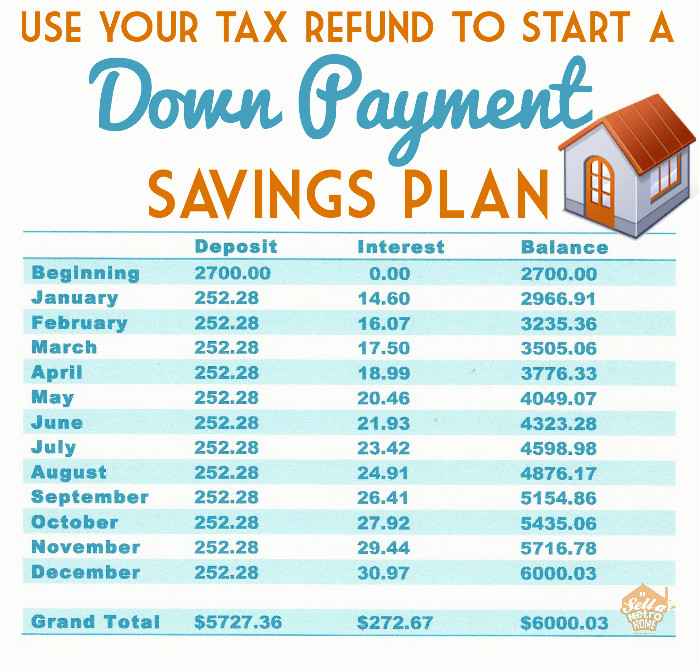

Open a dedicated savings account for your down payment, cut your spending, pay off high interest debt, and perhaps get a second job to supplement your savings plan. Your down payment plays a role in determining your loan-to-value ratio, or LTV. To calculate the LTV ratio, the loan amount is divided by the fair market value determined by a property appraisal. Investment property is real estate you buy to earn a return on your investment through rental income, reselling the property or both. Homes that only need a few minor repairs can be a bargain for new buyers.

The 20% down payment recommendation can make homeownership feel unrealistic – but the good news is that very few lenders require 20% at closing. That said, making a down payment that equals 20% of a home’s purchase price offers advantages. Buying a house that requires immediate repairs will increase these costs. Before buying a home, make sure you know what expenses you’re getting into and that your savings account has enough money to cover them in addition to the down payment and closing costs.

Once you’ve saved your down payment and decided which mortgage loan best suits your needs, you’re ready for action. Start your mortgage application with a Home Loan Expert at Rocket Mortgage. You won’t get a zero-down conventional loan, but you can get a zero-down government-backed loan. If these numbers seem steep, remember the amounts will be lower for a house below this price point.

Next steps to get a mortgage

You may have been told that 20% is the magic number when it comes to how much of a down payment you need for a house — but in reality, the upfront financial commitment doesn’t need to be that substantial. In fact, the average down payment on a house varies between 6% and 17%, according to data from the National Association of Realtors (NAR). Ultimately, though the amount you’ll pay will depend on your loan program and financial situation. A down payment is the upfront portion of a payment that is often required to finalize the purchase of items that are typically more expensive, such as a home or a car.

FHA-insured loans require a down payment of some kind, although you can apply grants and down payment assistance benefits to offset this cost. Some qualifying mortgage programs include an FHA 203(b) purchase loan and the FHA 203(k) rehab loan. For example, you can be eligible for a conventional loan with as little as 3% down. Government-backed programs such as FHA loans, VA loans or USDA loans can require 0% to 10% but are more likely to charge upfront and annual fees. The size of your down payment depends on your savings, income, and budget for a new home.

Keep in mind, too, that to avoid PMI, you’ll need to put down at least 20 percent. If you can’t afford that high of a down payment, though, know you won’t pay PMI forever. Once you reach 20 percent equity in your home, you can request that your lender remove PMI from your bill. For a conventional loan, you’ll need to put at least 20% down to avoid PMI.

Enter the price of a home and down payment amount to calculate your estimated mortgage payment with an itemized breakdown and schedule. Down Payment Assistance Programs—Local county or city governments, local housing authorities, and charitable foundations sometimes provide grants to first-time home-buyers. Down payment assistance is usually only reserved for need-based applicants purchasing a primary residence.

If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. 1 Client will be required to pay a 1% down payment, with the ability to pay a maximum of 3%, and Rocket Mortgage will cover an additional 2% of the client’s purchase price as a down payment, or $2,000. Offer valid on primary residence, conventional loan products only.

So, next, let’s explore the pros and cons of different low-down-payment mortgages. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals.

A down payment is part of the homebuying process and a requirement for some of the most popular types of mortgages. When you are preapproved for a mortgage, a lender determines the maximum loan amount you qualify for based on responses in your application. A pre-approval letter from the lender shows sellers that your financial information has been verified and you can afford a mortgage. VA loans and USDA loans can have a zero-down payment, but you must meet the minimum qualifications set by both programs.

Deciding on Your Home Down Payment: a Comprehensive Guide - Business Insider

Deciding on Your Home Down Payment: a Comprehensive Guide.

Posted: Thu, 14 Mar 2024 07:00:00 GMT [source]

With an upfront down payment of 20% at $72,600 plus necessary closing or settlement costs averaging 4.5% of the purchase price, the sum needed for the house purchase would be $88,935. Because jumbo borrowers present more risk for a lender, expect to put down 10% to 20% of the purchase price. Borrowers with credit scores of 700 or higher tend to get the best pricing, but some lenders will work with jumbo borrowers with a minimum score of 660. A lower LTV ratio presents less risk to lenders because you are adding more equity to your home and have a higher stake in your property relative to the outstanding loan balance. Since lenders use LTV to price mortgages, a lower LTV means you'll likely pay a lower interest rate on your mortgage.

No comments:

Post a Comment